MOBILE MONEY INCREASES THE ECONOMY AND GDP OF UN-BANKED COUNTRIES

…in many ways:

Higher productivity

The time for formal processes like payment of utilities or phone bills can be used productively. A 2 day trip to a larger city with hours in queues are not unusual in developing countries and can be avoided by using mobile money transfers which take 5 minutes. Being able to pay ‘online’ (for someone with no bank account and no credit card) also opens up mobile information channels like trade values, weather, health, education – which can increase productivity directly and indirectly.

Remittance

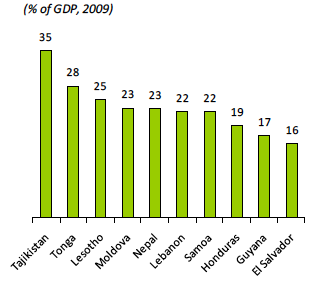

Remittance can contribute substantially to a countries GDP. Tajikistan is leading with a whopping 35%¹. Many families spending depends on the money sent back from labour and expat workers abroad. Making the process easier with mobile money, increases the probability of funds getting sent (instead of spent).

Replace cash with electronic money

Fiat money (touchable money) today only represents 5% of all existing money². Electronic transactions save up to half of the all-in costs compared to paper transactions. The cost savings resulting out of the substitution of paper based transactions would save up to 0.7% of a national GDP annually. But will cash ever disappear? Never. All types of electronic money leave traces and there is sufficient criminal energy in the world with sufficient influence to prevent that. It would stay completely undetected if one would move a few 100 USD notes across a border, while the records of a 10 USD mobile money transaction can be traced back for years.

Timing

Cash is often left in a safe place to avoid theft. Mobile Money is carried with the person on the mobile account. The theft of the phone does not enable the thief to get the money due to the missing authentication. The availability of exchange units at the time of the purchase desire increase trade. The Increase in trade ultimately increases the GDP.

Credit creation through aggregation

The exchange of fiat money to electronic money can create a credit when there is a time delay with balancing out cash and electronic money from an agent through different stages of aggregator levels. Meaning one level of aggregator ‘borrows’ electronic money or cash to the another level until the balance is cleared, which can be between days to probably a week. The credit creation – like any other credit creation positively increases the GDP in a country.

Access to international purchasing power is another contributor, although still small. But look at this example. Would this person have had a chance to sell his music? Please click here for more artist and for buying one of the songs for less than one pound (80% goes to artist): Mukuru

Source:

¹Remittance Factbook 2011, World Bank

²The Oxford Handbook of Banking; Berger, Molyneux and Wilson